Market Watch July 2020

/Market Watch July 2020

Market Watch July 2020

The Toronto real estate market experienced a very pleasant but unexpected jump in sales last month. Toronto real estate board members reported the sale of 4,606 homes which was only down 53.7% compared to the month before where the number of sales were down 67% from April 2019.

The biggest surprise came in the form of Toronto prices. Despite headline grabbing negativity about Toronto prices, Toronto average price increased by 3% from the previous month, and up 7.2% (now $878,449) over the 2019 average price of $819,305.

We are seeing the market coming off of its “pause” as people are getting back into the market and these results are a further indication of the high demand and desire for home ownership in the GTA.

We at Realtron have seen a consistent increase in the number of phone calls into our offices and requests for appointments on our properties, and our offices are now open, but with appropriate safety measures for our agents, our staff our clients. Being an essential business, it is incumbent upon us to operate in a very safety conscious way, with appropriate safety gear, virtual showings, virtual Open Houses, electronic document signing and minimizing direct exposure to each other.

Clients continue to ask me, “Is it a good time to buy or should I wait?” My answer has always been the same. “As the population of the GTA continues to grow, prices will continue to go up. Like the stock market, you cannot time the market. Find a good property that you and your family will enjoy. Find a good investment property you can rent out long term. Over time you will not make a mistake.”

It’s a great time to upgrade your property. It’s a great time to buy an investment property. Give me a call, let’s talk. If you know of someone thinking of buying and selling, please let me know. After all, you have a friend in real estate!

Have a great June!

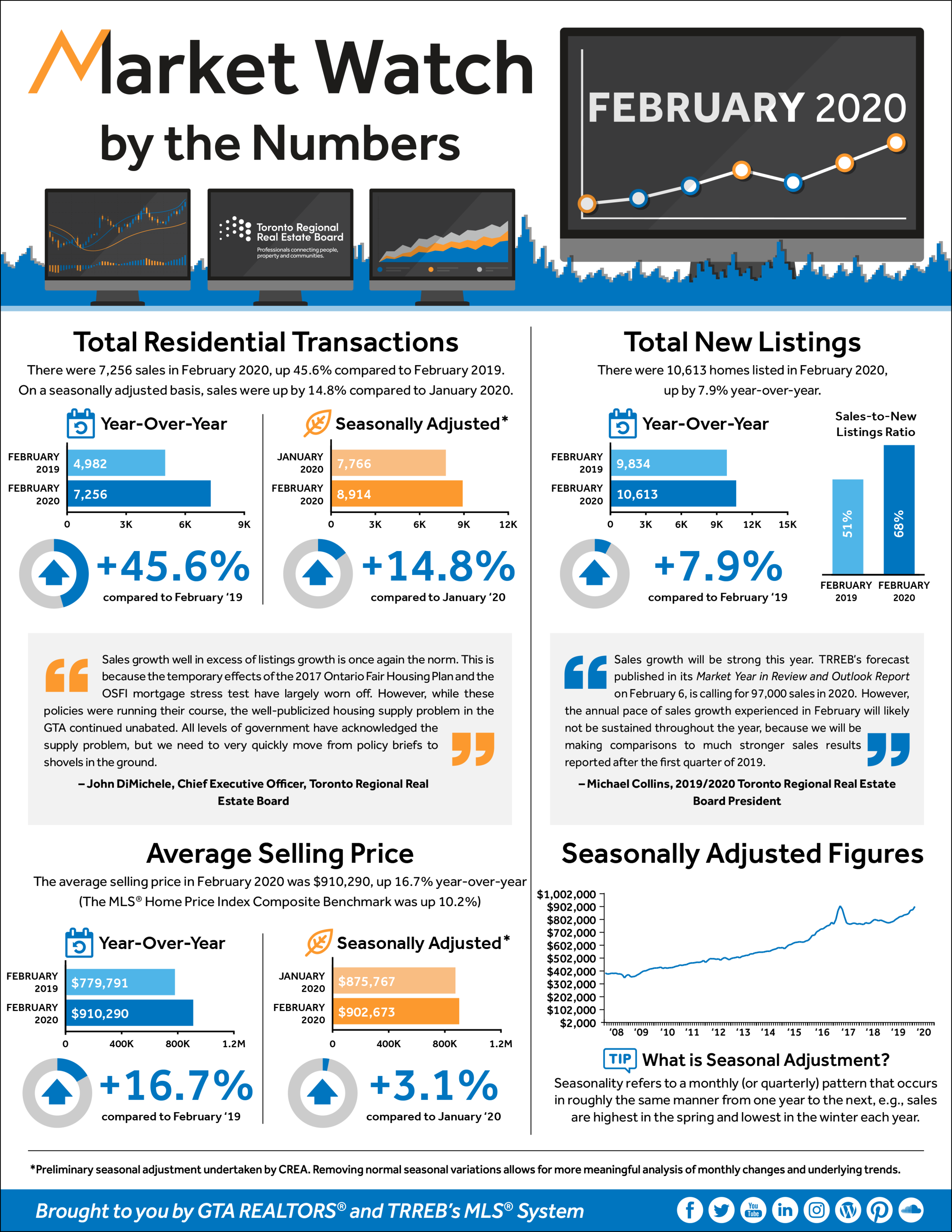

TORONTO, MARCH 4, 2020 – In line with the forecast contained in the Toronto Regional Real Estate Board’s recently released Market Year in Review and Outlook Report, TRREB President Michael Collins announced a very strong year-over-year sales and price growth in February 2020. Greater Toronto Area REALTORS® reported 7,256 residential transactions through TRREB’s MLS® System in February 2020, representing a 45.6 per cent increase compared to a 10-year sales low in February 2019. However, February 2020 sales were still below the 2017 record result. Year-over-year sales growth, for the GTA as a whole, was strongest for ground-oriented home types. After preliminary seasonal adjustment, February 2020 sales also exhibited positive momentum, up by 14.8 per cent compared to January 2020. New listings amounted to 10,613 in February 2020, a 7.9 per cent increase compared to February 2019. This moderate annual growth rate was much smaller than that reported for sales, which means market conditions tightened considerably over the past year. As market conditions tightened over the past year, competition between buyers has clearly increased. This resulted in a further acceleration in year-over-year price growth in February. The MLS® Home Price Index Composite Benchmark was up by 10.2 per cent. The average selling price for all home types combined was up by 16.7 per cent to $910,290. Double-digit average price growth was experienced for most major market segments, including detached houses and condominium apartments.

Official Press Release

The Bank of Canada today lowered its target for the overnight rate by 50 basis points to 1 ¼ percent. The Bank Rate is correspondingly 1 ½ percent and the deposit rate is 1 percent.

While Canada’s economy has been operating close to potential with inflation on target, the COVID-19 virus is a material negative shock to the Canadian and global outlooks, and monetary and fiscal authorities are responding.

Before the outbreak, the global economy was showing signs of stabilizing, as the Bank had projected in its January Monetary Policy Report (MPR). However, COVID-19 represents a significant health threat to people in a growing number of countries. In consequence, business activity in some regions has fallen sharply and supply chains have been disrupted. This has pulled down commodity prices and the Canadian dollar has depreciated. Global markets are reacting to the spread of the virus by repricing risk across a broad set of assets, making financial conditions less accommodative. It is likely that as the virus spreads, business and consumer confidence will deteriorate, further depressing activity.

In Canada, GDP growth slowed to 0.3 percent during the fourth quarter of 2019, in line with the Bank’s forecast, although its composition was different. Consumption was stronger than expected, supported by healthy labour income growth. Residential investment continued to grow, albeit at a more moderate pace than earlier in the year. Meanwhile, both business investment and exports weakened.

It is becoming clear that the first quarter of 2020 will be weaker than the Bank had expected. The drop in Canada’s terms of trade, if sustained, will weigh on income growth. Meanwhile, business investment does not appear to be recovering as was expected following positive trade policy developments. In addition, rail line blockades, strikes by Ontario teachers, and winter storms in some regions are dampening economic activity in the first quarter.

CPI inflation in January was stronger than expected, due to temporary factors. Core measures of inflation all remain around 2 percent, consistent with an economy that has been operating close to potential.

In light of all these developments, the outlook is clearly weaker now than it was in January. As the situation evolves, Governing Council stands ready to adjust monetary policy further if required to support economic growth and keep inflation on target. While markets continue to function well, the Bank will continue to ensure that the Canadian financial system has sufficient liquidity.

The Bank continues to closely monitor economic and financial conditions, in coordination with other G7 central banks and fiscal authorities.

The next scheduled date for announcing the overnight rate target is April 15, 2020. The next full update of the Bank’s outlook for the economy and inflation, including risks to the projection, will be published in the MPR at the same time.

RE/MAX Realtron Barry Cohen Homes Inc., Brokerage | Lance Stoute, Broker of Record

309 York Mills Road Unit 7 TORONTO, ON M2L 1L3 CANADA | P. 416-223-1818 F. 416-223-9544

Not Intended to solicit parties already under contract. | Each office is independently owned and operated

Powered by Squarespace.